Seasons – Summer 2014

Dear Plateau family,

Director of Sales, Tim Milligan

The year seems to have flown by and another hot, Texas summer is upon us again. Although this spring has been wetter than usual, we all know the dry season is now here. The rain has been kind this spring, allowing the flora and fauna to thrive. As we prepare ourselves for the heat and all the fun activities that may include, we must also remember how summer can affect our land. Whether your land is going through the recovery process from the recent rains after a lengthy drought, or you have received notice from your county appraisal district that your wildlife or ag valuation has been pulled, we hope you find useful information in this issue of Seasons where we cover an array of issues that affect landowners during this time of year.

As you kick back, relax and soak up this hot Texas sun, please scroll through this issue of Seasons where we also provide you with useful information about old property easements, estate planning information, and review your seasonal activity highlight checklists.

We hope you enjoy the read and everything this summer has to offer, and if there’s any way Plateau can help you protect, enhance or better enjoy your land during this special season, just give us a call. We’ll be here when you need us.

Tim Milligan

Director of Sales

Plateau Land & Wildlife Management

(512) 894-3479

[email protected]

Table of Contents

The Drought and Recovery Management

What Every Buyer of Rural Land Should Know About Old Property Easements

Drought and the Tax Code

Summer Wildlife Management Activities Checklist

Saving the Land by Sharing the Tax Exclusion

Have You Lost Your Wildlife Management or Ag Valuation This Tax Year?

The Drought and Recovery Season

How to protect your property during the recovery period after recent rainfall by Craig Bowen, Account Manager – Cross-Timbers Region for Plateau Land & Wildlife Management

“And it never failed that during the dry years the people forgot about the rich years, and during the wet years they lost all memory of the dry years. It was always that way.”

“And it never failed that during the dry years the people forgot about the rich years, and during the wet years they lost all memory of the dry years. It was always that way.”

John Steinbeck wrote those words in 1952, at the beginning of one of the worst droughts in the history of Texas. This drought changed the landscape of Texas, and particularly the mindset of its ranchers. Cattle ranchers had to adjust, and eventually bought cheaper and hardier sheep or goats, which can ultimately damage the landscape further and be more competition for existing wildlife. The cattle industry has never fully bounced back in the western area of the state; some ranches remain badly overgrazed, and other signs of long-term drought stress can also be observed.

Savvy wildlife and livestock managers have long approached land management with a “prepare for the worst” mentality as their strategy for dealing with the unpredictable Texas weather patterns. They know the more the land has left to give at the end of the growing season, the more it will give the next year. This management style leaves at least half of any available food, water, or shelter for grazing and browsing animals. Leaving half ensures there will be at least that much the next year, and thus no more will ever be taken than what the property has to offer.

The good news is droughts do end. This usually occurs following an approximate 30-year cycle, with ebbs and flows similar to that of a radio signal graph. There are invariably wetter periods within a drought cycle. The years after a drought and the “good” years during one are often confusing for rural property managers. Do these wet years require a different stocking rate? Should one decrease hunting pressure to propagate more deer? Do quail and other vulnerable animals need as much human input now that it is raining? The same questions can be asked whether the drought is over or just in a “rich period.” The answers, unfortunately, depend on the property. There are many aspects to addressing this issue, but there are two main components of habitat to focus on water and food.

Regardless of what animals the property owner is managing, water distribution on the property is the most important aspect of drought management. The quantity of water is not nearly as important as the distance traveled to reach the water source. A 10-acre lake is great, but if it is on the other side of a 1,000-acre property, animals can be distressed just getting to it, if they can reach it at all. Without human intervention, animals hydrate using dew on plant leaves, and water inside of plants, especially grasses, and succulents. They can also hydrate from small puddles and pools, such as a deep place in a wet weather creek, or a small depression in a granite outcropping. A general recommendation is to have a man-made or natural water source every ¼ to ½ mile. Using rainwater harvest devices and float-fed troughs is often the most economical way to achieve this distribution.

Food is not as universal as water in that different animals eat different types of food. Herbivores vary from strict grazers who eat up to 85% grass, to strict browsers who eat only 15% grass (or less), and fill their diets with forbs (weeds) and browse (leaves and twigs). Across the spectrum of grasses, forbs, and browse plants, there are preferred plants, less preferred plants, and plants animals would only eat as a last resort. During drought periods, preferred plants are used heavily without adequate replacement, even in the best stocking rate situations. That means if stocking rates are not reduced during extended drought periods, the less preferred plants will become the top tier, and so on along that pattern. Many of these first and second tier plants are also the plants which produce the most valuable seeds and berries, so the impact on songbirds and small mammals is very real.

At this point, most Texas properties are facing a prolonged recovery, exhibiting very early succession plants for long periods of time. This holds soil in place, reduces soil temperatures by shading, and gives more desirable plants a chance to recover (remember, they are always being eaten at a higher rate, and having a more difficult time catching up). Moreover, erosion during flooding rains, usually following drought periods, removes valuable seed banks and lessens the chance of a successful recovery.

In regard to food, the types of grazing animals on a given property holds great bearing on how to manage them. Exotics like axis deer, fallow deer, sika deer, and blackbuck antelope are able to switch their diets during drought periods, changing from primarily browse to primarily grass and forbs. This means that animals not directly competing with native browsers (white-tailed deer) are now in intense competition for rare food resources. White-tailed deer do not have the capability to make this dietary switch. The old saying that a white-tailed deer “will starve to death with a belly full of grass” is true because they cannot readily digest lignin, a key component to grass’s cellular make-up. Therefore, not only can drought harm animals through directly reducing their food sources, it can increase competition amongst similar types of animals and reduce herd health in white-tailed deer populations.

Much of the Texas Hill Country is overgrazed and over-browsed because it is not productive enough to sustain constant grazing or a high level of browsing. Most landowners, especially multi-generational farmers and ranchers, blame the “current” lack of rainfall for these poor conditions, but the state of the land when entering the drought has a big impact. In fact, rainfall patterns are constantly changing, and adaptive management during low rainfall periods and during recovery periods instead of managing for the “rich years,” is the best way for a property to remain productive. That may mean back-to-back years of very light or no grazing, reducing a deer herd on a well-managed ranch, or spending money to increase water infrastructure. Taking these steps will result in a greatly improved property, and as the property makes its way out of the drought period, it will recover quicker and stronger than could have ever been imagined.

So, if you are looking for the best way to manage during a drought or coming out of a drought, learn the plants on your property. Take a look at the indicators mentioned here, and begin to understand what they are telling you. Texas rural land can be managed and managed well, even with our infamous changing weather patterns. Give the property a break, give it time to recover, and do not demand more than it can give. Realize that there are hundreds of species depending on your stewardship, and seek help from a competent biologist, like those here at Plateau Land & Wildlife, if you are unsure of what path to take. And remember the rich years, because they will return.

Back to TopBack to Top

What Every Buyer of Rural Land Should Know About Old Property Easements

By Patrick Reznik, Attorney at Braun & Gresham, PLLC.

As Texas continues to grow its infrastructure across the state’s private rural lands, potential litigation related to old easements is becoming a more serious issue. Buyers of rural land often fail to identify the existence of “unmaintained,” but legal “blanket” easements in the title commitments. Blanket easements may allow the company to use the whole property for its purposes. This can leave landowners vulnerable to the legal rights of oil and gas pipeline companies or electric utilities that may decide to upgrade, maintain or construct new facilities on the land after decades of inactivity.

Some of my clients recently came home from work to discover that a pipeline company had cleared more than a 100-foot wide strip of old growth trees directly in front of their home. They chose this property because of the beautiful view. The company said it needed to “maintain” its easement and install some corrosion control devices, which it never installed. Understandably, these landowners believe their land has been seriously devalued.

Purchasing land is a serious investment. Thus, fully understanding the liabilities associated with the purchase of a property is essential. These old easements are generally listed as exceptions to the title policy. The buyer should request these documents from their title company and carefully review the language with an attorney. Without careful review, a buyer may not realize a permanent easement exists under the old growth of an oak grove which was part of what incentivized the buyer to purchase this particular property in the first place. This could surface as a serious liability to the value of the property. Especially, if a company, without advanced notice to the landowner, decides to maintain or construct on its old easement by cutting down all those trees.

In a separate case, and without notice to the landowner, a company cleared multiple 50-year-old native oak trees along a 75 foot wide strip in order to install an additional pipeline. To the owners’ amazement, the old easement called for paying only “twenty-five cents per lineal rod”! In both of these cases, the companies had blanket easements on the properties, and the owners were not aware of the old easements when they purchased the properties.

In certain circumstances, for pipe laid under the threat of eminent domain prior to January 1, 1994, Texas law limits the width of pipeline easements to 50 feet. Pipeline companies who clear beyond that 50 feet may be subject to a valid lawsuit and be responsible for monetary damages.

By reviewing the current easements on a property, Braun & Gresham, PLLC has helped landowners identify the current liabilities and their legal impacts, as well as provided sound advice on whether better terms may be negotiated with the easement owner. We recently re-negotiated an old blanket easement to define the exact location and width of a pipeline easement, protecting the rest of the property from the blanket easement. We have also recently helped a landowner convince the title company, who argued a telephone easement was a blanket easement, to remove it from its exceptions to the title policy.

Regardless of whether you recently purchased your property or it has been in the family for 100 years, it is important to understand the easements that impact your land and its value. Understanding your property rights also applies to newly negotiated easements that will likely last for many future generations. With the assistance of an attorney, you or future owners may be able to avoid unwanted litigation or the heartbreak of losing one of your favorite features on the property.

Back to TopBack to Top

Drought and the Tax Code

By Shane Kiefer, Director of Ecological Services for Plateau Land & Wildlife Management

Water and drought are constant topics amongst Texas landowners, especially for landowners who are trying to maintain an open space valuation on their land. Fortunately, the state passed a law to help agricultural producers and landowners maintain their open-space valuations when drought conditions necessitate more extreme actions to protect the land. While the law has been around for a few years, its importance to landowners has become more evident as this current drought lingers.

As most of you are probably aware, 2011 was the worst single-year drought on record. That year, on July 5th, Governor Perry issued an emergency drought proclamation that brought into effect a section of the Texas Property Tax Code (Sec. 23.522) that was added by the legislature via S.B. 771 in the 2009 session (how is that for good timing?). This section, titled “Temporary Cessation of Agricultural Use During Drought”, permits a landowner to do just that, cease agricultural production during a governor-declared drought without fear of losing their open-space tax valuation when there is “an agricultural necessity to extend the normal time the land remains out of agricultural production”.

The number of counties included in the 2011 declaration has varied, but at any given time no fewer than 100 Texas counties were included, most of them continuously since the original declaration, which was renewed once again on June 9, 2014 for the 34th time with 166 counties included. That’s 2/3 of the counties in Texas.

Prior to 2009, the open-space laws already permitted “leaving land idle in conjunction with normal crop or livestock rotation procedure” as long as the land was used principally for agricultural use for 5 years out of any 7-year period. So, why the need for this law? There are two principle reasons:

- There is nothing magical, much less scientific, about the two years of rest afforded by the tax code for open-space agricultural use. In a state where average annual rainfall varies from greater than 54 inches on one end to less than 14 inches on the other, two years of rest may not be sufficient during normal times on every property. This law permits added flexibility for producers when there is an “agricultural necessity”, but only when conditions turn for the worse as dictated by the governor.

- Contrary to popular opinion, while the two years of rest are allowed as part of your agricultural history, the tax code does not require an appraisal district to continue granting the open-space valuation during those two years when completely ceasing agricultural production, especially if the rest is not a “normal…rotation procedure” for your local area.

In practice, most (if not all) appraisal districts consider a two-year rest (particularly in dry times) part of a normal procedure and will leave a property in open-space. However, this emphasizes the importance of informing your appraisal district whenever you want to enter a rest period, particularly if it involves completely removing all livestock from your property.

The 2009 drought provision in the tax code ensures that your open-space valuation is protected during an officially declared drought even if you must completely cease agricultural production for an extended period of time (until the drought declaration ends). When the drought declaration is over, you must return the land to the proper intensity of use.

With all that said, wildlife management use remains an excellent alternative to simply resting your land. It is a form of agricultural use, so you never lose your history, but it provides the ultimate flexibility to rest all or part of your land and then return to agricultural production whether the governor declares a drought or not. Keep in mind that the official drought declarations may end well before the land has had a chance to recover fully. In addition, appraisal district interpretation and application of the drought provision varies widely, so the mere presence of the law does not guarantee freedom from conflict. Be sure to communicate with your appraisal district or give Plateau a call if you have any concerns.

What about those of you already in wildlife management? While the law does not specifically exclude it,it remains slightly different than traditional agricultural uses because there is no “agricultural necessity” to cease wildlife management use during a drought, just like “resting” from wildlife management use is not a normal rotation procedure during normal times. So, landowners with a wildlife valuation must keep performing the minimum of three out of seven practices every year. In most cases, these practices become even more important during a drought (supplemental water, controlling deer numbers, etc.). For those activities that may not be viable during a drought (planting food plots, for instance), I recommend replacing them with another activity that addresses the needs of your target species.

If you are concerned about the drought’s impact on your property or the wildlife that use it, give us a call. As always, let us know whenever we can be of service.

Back to TopBack to Top

Summer Wildlife Management Activities Checklist

By Kameron Bain. Business Development Manager for Plateau Land & Wildlife Management

Summer is here which not only marks the return of the heat, but the halfway point of the year. This is a perfect time to sit in the air-conditioning with your favorite cold beverage and pull out your wildlife management plan for review. Take a look at which of your activities you have completed and make sure you have the proper documentation. Also, plan out what needs to be done before the end of the year.

While the lazy days of summer are just beginning it is important to remember that there are a lot of wildlife management activities that are done this time of year. Here is list of qualifying activities:

- Chemical Control- Late Summer is a good time to treat prickly pear

- MLDP Paperwork- Due August 15

- Deer Surveys- Start in August

- Pond Construction

- Pond Renovation and Repair

- Imported Red Fire Ant Control

- Strip Mowing- Late July and August

- Half-cutting

- Supplemental Water Maintenance

- Small Mammal Surveys

Saving the Land by Sharing the Tax Exclusion

By Margaret Menicucci, Attorney at Braun & Gresham, PLLC.

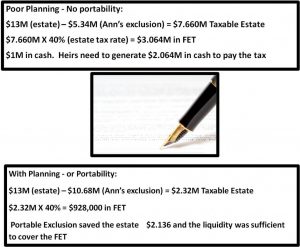

Estate planning is easy to postpone. You know it is important, but it can also be hard to discuss. There are Texas-sized reasons, however, for a rural landowner to develop (or re-visit) an estate plan. The first reason is rising land values. Given the changes in the Texas economy, your farm or ranch may now cause your estate to be taxable, even though you do not have liquid assets like cash accounts to pay that bill. This could leave your children in the difficult position of having to sell part of the land to satisfy the estate tax obligation. The second reason is that Congress has provided tools that help you manage and even avoid that estate tax liability, but you have to follow specific steps to benefit from them. Those tools are the high individual estate tax exclusion amount of $5,340,000 per person in 2014 – and “portability” of that exclusion between spouses. Portability means that in some circumstances, spouses can share the unused portion of their estate tax exclusion. Careful use of a will and of the portability rules can save your land for future generations to enjoy.

Let’s look at an example of married landowners Ann and Arthur. Arthur dies giving all of their property to Ann through his will. The unlimited marital deduction applies, making Arthur’s taxable estate zero (or near zero if he gave some other, smaller gifts to children). No tax liability means that Ann does not have to sell a portion of the land to generate cash. Additionally, all or most of Arthur’s estate tax exclusion went unused. That exclusion becomes “portable” meaning it can be shared with Ann. The executor of the estate must file a form 706 with the IRS within nine months of Arthur’s death to successfully share the exclusion with Ann. When Ann dies, through her will she passes the land to their children. There is no marital deduction this time, so the individual estate tax exclusion applies. With portability, Ann’s exclusion is up to $10,680,000!

The calculations in the box to the left show the tax consequences when Ann dies under two scenarios – 1) no portability of Arthur’s exclusion and 2) portability, because the executor timely filed the form 706. To make it easy to follow, we assumed that at the time of Ann’s death, the ranch was worth $12 million and the estate had $1 million in cash.

The calculations in the box to the left show the tax consequences when Ann dies under two scenarios – 1) no portability of Arthur’s exclusion and 2) portability, because the executor timely filed the form 706. To make it easy to follow, we assumed that at the time of Ann’s death, the ranch was worth $12 million and the estate had $1 million in cash.

Some may think that their estate is not big enough for them to worry about estate planning. That cannot be further from the truth! Land values and circumstances can change, so you want to be in the best position to manage the estate tax liability while preserving your land for the future. Through estate planning, you develop a will that makes the most sense for your family, you identify strategies for tax minimization, and you think through how to use gifts during your life and at death to ensure that the land is preserved and properly managed. The estate tax professionals at Braun & Gresham are experienced in helping rural landowners develop and implement estate plans. They are knowledgeable about the unique value of rural land as an asset.

Back to TopBack to Top

Have You Lost Your Wildlife Management or Ag Valuation This Tax Year?

By Ryan Colleen Swartz, Marketing Coordinator

It is that time of year again – protest season. Unfortunately, every year appraisal districts pull agriculture and wildlife management valuations on properties and landowners have to fight to get them reinstated. Receiving news from the appraisal review board (ARB) that you are losing your valuation can be very discouraging and worrisome. However, fear not, we can help! Once you receive your notice of final order from the ARB, a lawsuit against the county appraisal district must be filed within 60 days in order to re-instate your ag or wildlife management valuation. In some cases, we have been able to quickly settle the lawsuit. If your ag or wildlife management valuation has been denied in 2014, call Cassie Gresham, Attorney for Braun & Gresham, PLLC. for a free 30-minute consultation.

Back to TopBack to Top

Sorry, the comment form is closed at this time.